Economic Snapshot April 2024

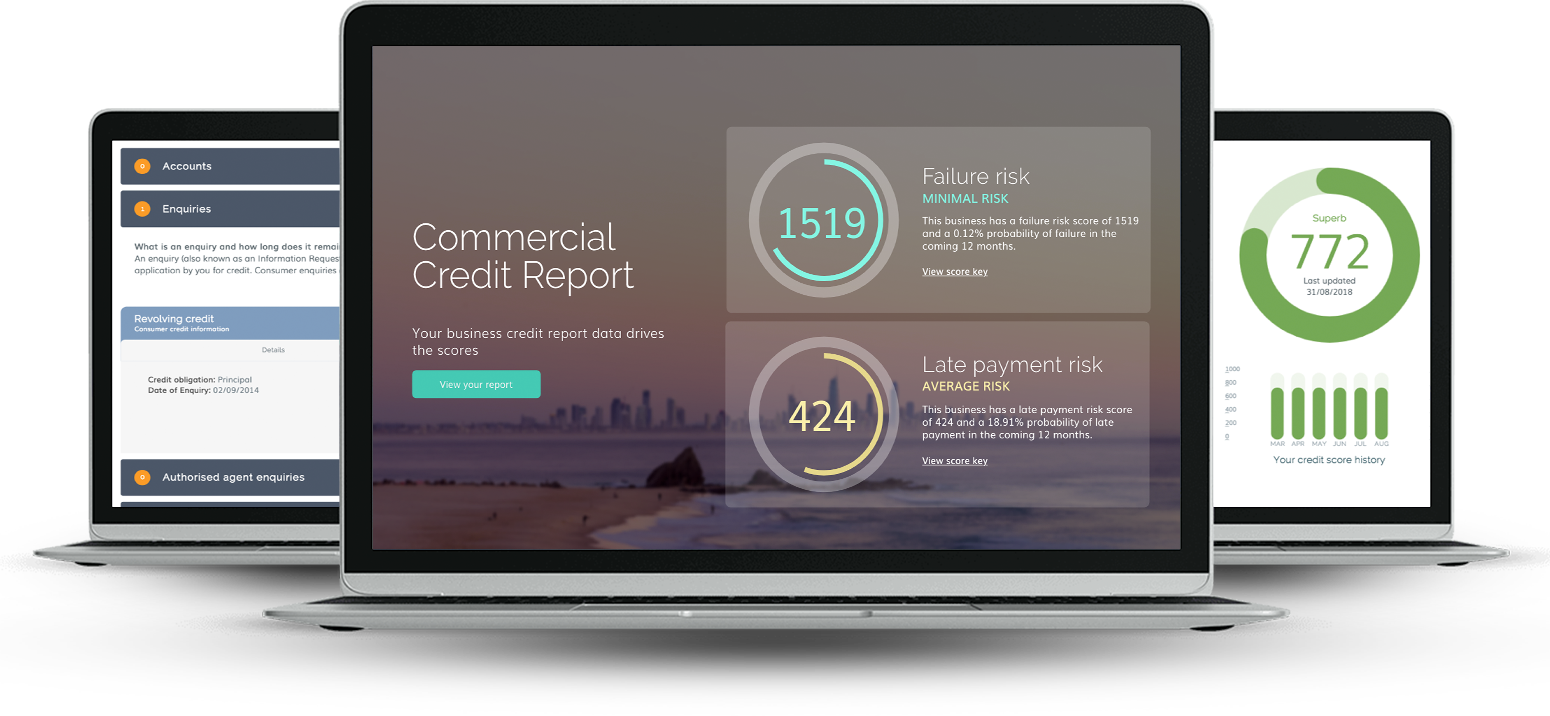

We have seen a significant surge in business insolvencies in FY2023 and FY2024, a trend that is likely to continue for the remainder of the financial year.

With the continued increase in economic challenges, will companies be able to adapt?

Find out…